A promissory note for a car is written evidence of the loan transaction between a borrower and a lender. People often take loans to purchase cars, and a promissory note is then prepared by adding the details of the Lender, borrower, loan amount, interest rate, and repayments. This note serves as a promise on behalf of the borrower that he will repay the Lender the loan taken for the car.

This is duly signed by the borrower, Lender, and witness and is a legally binding agreement that can be used to claim the money or sue in court.

A promissory note for a car can be of two types:

- Secured: This type of loan is secured with any borrower’s assets. In case of default, the borrower will have to sell the collateral to make the Lender’s payment.

- Unsecured: The loan repayment is not secured against anything in this type of promissory note, and in case of default, the Lender would have to approach the court for legal proceedings.

When a car loan is taken, a promissory note can be drafted from scratch, or a template can be downloaded from online sources. Programs like Microsoft Word can also be customized according to the details and requirements.

Depending on the nature and amount of the loan transaction and the Lender’s demands, different promissory notes can include varied information and details.

As a legal document, some lenders and borrowers need it to be comprehensive to avoid ambiguities and legal issues. Sometimes, a detailed separate repayment schedule is also included with the promissory note.

However, the general details included in a promissory note for a car are:

- Date of the promissory note.

- Date of loan.

- Loan amount.

- Details and signature of the borrower.

- Details and signature of the Lender.

- Signature of the witness.

- Repayment schedule.

- Interest rate.

- A grace period of late payments, if any.

- Secured or unsecured.

- Conditions in case of default.

Sample Notes

Note 1:

I, XYZ, agree to pay John Doe $12,000 to purchase his vehicle (model and number). This amount shall be paid in 24 monthly installments of $500 each, with an interest rate of 1.5%. Every installment will be due on the 15th of each month, starting December 15, 20XX.

In the event of installment non-payment for two consecutive months, Mr. Doe reserves the right to repossess the vehicle. Disputes shall be resolved under the jurisdiction of ABC.

Note 2:

I, XYZ, owe Miss Jane Doe $7,000 for the purchase of her 20XX Toyota Corolla. I agree to repay this amount with an interest rate of 3% over 12 months. Each monthly payment will be $600, due on the 1st of each month. The first installment will be paid on November 1, 20XX.

If I miss a payment, I agree to pay an additional $50 as the late fee. Moreover, if I delay the payment for more than 45 days, Miss Doe may reclaim the vehicle.

Below are my signatures as proof that I agree to all the abovementioned terms.

Note 3:

On this date, October 1, 20XX, I, (buyer’s Name), promise to pay (seller’s Name) the sum of $5,500 by January 15, 20XX, for the vehicle (model and number) that is officially being transferred to me. I have thoroughly inspected the car and accept it with all its minor flaws. I shall not make any claim or demand any reimbursement for future maintenance.

This agreement is for a one-time payment with no monthly installments. In the event of my failure to make the due payment by January 15, (the seller) reserves the right to repossess the vehicle.

This agreement is being signed in the presence of XYZ, an official witness of the deal.

Note 4:

This is to confirm that I, (borrower’s Name), am renting (Lender’s Name) a car for 10 days, from October 3, 20XX, to October 13, 20XX, at a rent of (amount) per day. An advance amount is being paid in the sum of (amount) today, October 2. The remaining amount will be paid when I return the vehicle to (Lender’s Name) on October 14.

I accept full responsibility for taking care of the vehicle while it is in my use and shall pay for any damages incurred during this period.

I also agree that (Lender’s Name) can seek legal assistance if I fail to make the remaining payment or return the car on the promised date.

#5

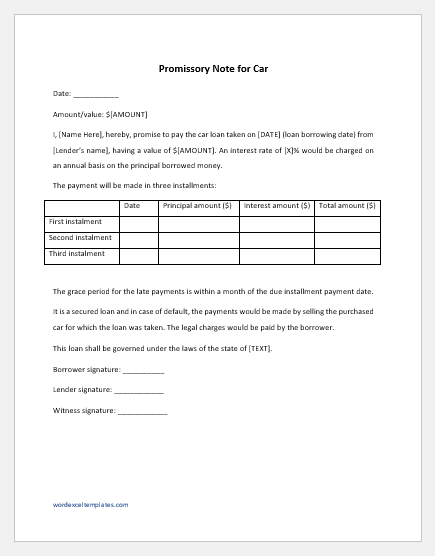

Date: ___________

Amount/value: $[AMOUNT]

I, [Name Here], at this moment, promise to pay the car loan taken on [DATE] (loan borrowing date) from [Lender’s Name], having a value of $[AMOUNT]. An interest rate of [X]% would be charged annually on the principal borrowed money.

The payment will be made in three installments:

| Date | Principal amount ($) | Interest amount ($) | Total amount ($) | |

| First installment | ||||

| Second installment | ||||

| Third installment |

The grace period for the late payments is within a month of the due installment payment date.

It is a secured loan, and in case of default, the payments would be made by selling the purchased car for which the loan was taken. The borrower would pay the legal charges.

This loan shall be governed under the laws of the state of [Text].

Borrower signature: __________

Lender signature: ____________

Witness signature: ____________

File: Word (.docx) and iPad

Size 22 Kb

- Ramadan Schedule Notification for Staff

- One Day Absent Note to Boss

- Request Letter to Staff for Voluntary Deduction from Salary

- Holiday Closing Messages

- Letter Requesting Transfer to another Department

- Letter Requesting Promotion Consideration

- Umrah Leave Request Letter to Boss

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

- One Hour Off Permission Letter to HR

- Payroll Apology Letter to Employee