Currently, almost all offices, whether big or small organizations, utilize a detailed employee expenses report, which is needed monthly or quarterly. This report highlights a complete and comprehensive review of the employee expenses, either monthly or quarterly.

All employees who have been involved in the small organization’s workplace must submit the expense report in case they have been paying out of pocket for their business expenses.

This employee expense report will completely itemize all of the reimbursable expenses. This will enable the owner to have a complete review of the expenses through the use of expense reports in favor of better accuracy and even reimburse their employees as the total amount.

Small organizations can also use expense reports to complete a review of the total expenses in a particular period. This can be either monthly, quarterly or even every year. The owners can get a complete overview of whether the expenses have been as high or as low as they expected. They can finally analyze the ending results.

Essential Elements Included In Employee Expense Report

Some of the essential elements or categories that are required to be included in the Employee Expense Report are as mentioned below:

- Advertisement

- Car or truck expenses

- Commissions or fees

- Contracting labor

- Employee-based benefit programs

- Insurance access

- Interest rates

- Mortgage rates

- Legal or professional services

- Office-based expenses

- Pensions or profit-sharing plans

- Rent or even lease

- Repairing and maintenance

- Taxes or licenses

- Travel or various meals

- Utility controls

- Wages rates

The reason why an employer needs to have an expense report?

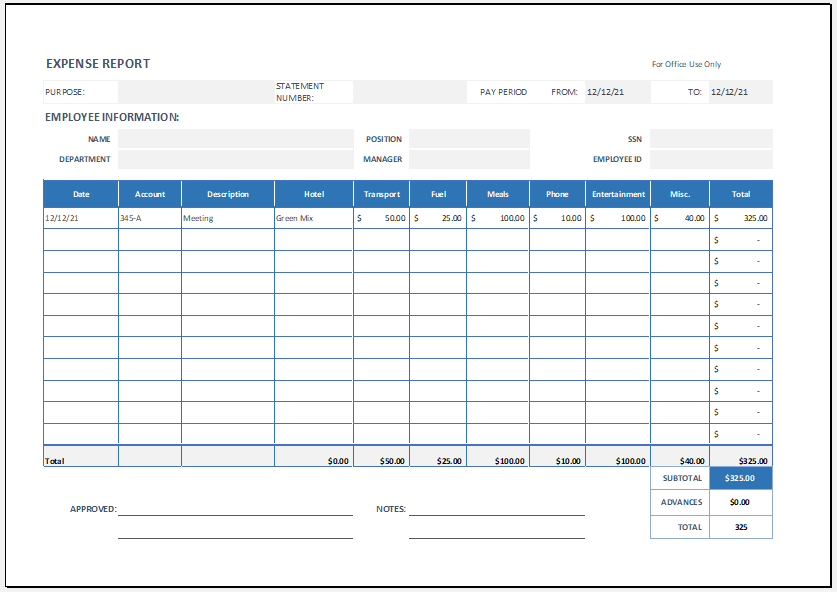

The employee expense report template is a ready-made template for you. This is one such report that needs to be filled out by the employee, given the expenditure information at specific places. It would work as a time saver for any employee because it keeps them away from the stress of figuring out the much-needed terms and the report’s main root.

Important Advantages

Now, let’s talk about the important benefits of employee expense reports! They are presented in different designations and combined with various customizable columns. These will include company name, employee name, date, company description, and category of expenses. It would also offer a collaborative set of features in which we have file attachments with some reminders and alerts. In short, it will benefit any office or company by maintaining accuracy and preventing unwanted expenses.

Conclusion

To sum up the whole discussion, we would say that the Employee Expense Report is not just meant for knowing the total expenses account; it is also important for the business incurs. When it comes to any downturn, companies will depend on the expense report to learn about the leading causes and those areas of business that have encountered an inevitable downfall.

File: Excel (.xlsx) 2007+ and iPad

Size 18 Kb

- Quarterly Tax Payment Tracker

- Baby Feeding Timer

- Payroll Tracker for Excel

- Allergy and Adverse Reactions Sheet

- Delivery Route Optimization Worksheet

- Energy Consumption Monitoring Worksheet

- Return on Investment (ROI) Calculator

- Investment Portfolio Tracker

- Equipment Utilization Worksheet

- Emissions Monitoring Worksheet

- Monthly Utility Consumption Worksheet

- Ramadan Schedule Notification for Staff

- Sales Tax Calculation Sheet

- Fixed Asset Register Template

- Advance Salary Tracker