Keeping track of everyday expenses is critical for small businesses’ financial planning and budgeting. Daily expense reports are an efficient method to manage finances and monitor expenses regularly. For this purpose, businesses employ a daily expense report sheet, a document that records and tracks the daily expenses of the firm.

How to make an expense worksheet?

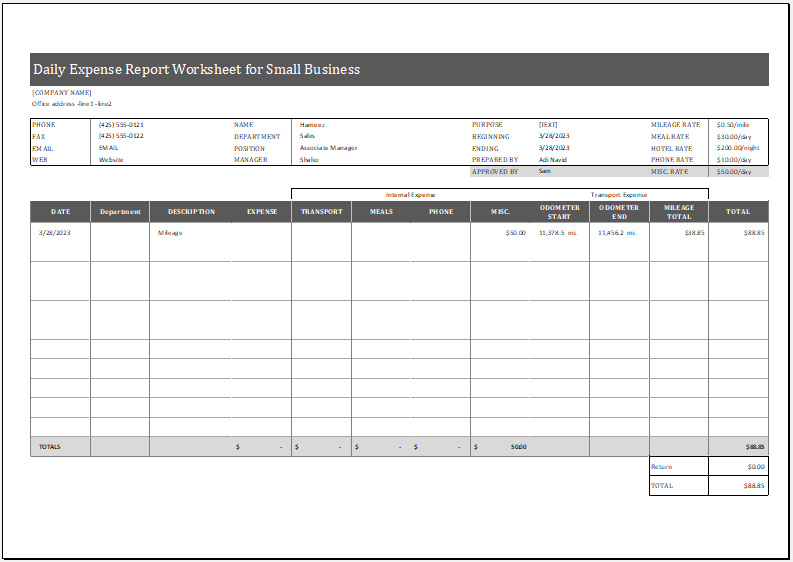

A basic spreadsheet software program, such as Microsoft Excel or Google Sheets, can be used to make the daily expense report worksheet. It can be tailored to the specific needs of the company. Some businesses may require more comprehensive information, whereas others may only require basic information to be recorded.

What to include in the worksheet?

The date, the item bought, the amount spent, and the purpose of the expenditure are all included in a daily expense report worksheet. The worksheet assists business owners in keeping track of their spending and identifying areas for cost savings. It is also beneficial in the preparation of precise financial statements and tax returns.

With modern data analysis tools, firms can now use these sheets to analyze their customer base and increase and decrease their expenditure accordingly. Similarly, data-driven decision-making also helps in overcoming tedious procedures.

The worksheet gives a clear picture of the financial position

For small companies, the importance of using a daily expense record worksheet cannot be overstated. It provides company owners with a clear picture of their financial position in real-time. This allows you to make more informed business decisions regarding future investments, expenses, and savings. Balance sheets are easily produced when the expense sheets are managed adequately as all sorts of shortcomings are avoided with the bottom-up approach.

A daily expenditure report worksheet also assists businesses in avoiding overspending and identifying cost-cutting opportunities. This is particularly important for small businesses with limited resources. It also helps to ensure that all expenses are properly recorded, which can be useful in the event of an audit.

Using a daily expenditure worksheet also simplifies the preparation of financial statements and tax returns. It eliminates the need to sort through stacks of papers and invoices, lowering the risk of mistakes. Small companies that keep accurate financial records can avoid penalties and fines that can result from inaccurate financial reporting.

Small companies with accurate financial records can confidently submit their financial statements and tax returns, knowing that they comply with legal and regulatory requirements. This maintains the business’ credibility with investors, customers, and other stakeholders.

A must-have tool for small businesses

Concluding, a daily expense report worksheet is critical for small businesses to successfully handle their finances. It also works as a feedback system by enabling business owners to track their expenses daily, find their shortcomings and plan accordingly to decrease unnecessary expenditures and save money. It also helps to ensure that all expenses are properly recorded, which can be useful in the event of an audit.

Using a daily expenditure report worksheet also simplifies the preparation of financial statements and tax returns. With all of these advantages, small companies should make incorporating a daily expense report worksheet into their financial management system a top priority.

MS Excel Worksheet Template

File Size: 120 KB

See also:

- Quarterly Tax Payment Tracker

- Payroll Tracker for Excel

- Delivery Route Optimization Worksheet

- Energy Consumption Monitoring Worksheet

- Return on Investment (ROI) Calculator

- Investment Portfolio Tracker

- Equipment Utilization Worksheet

- Emissions Monitoring Worksheet

- Monthly Utility Consumption Worksheet

- Sales Tax Calculation Sheet

- Fixed Asset Register Template

- Advance Salary Tracker

- Benefits and Deductions Worksheet

- Capital Expenditure Tracker Template

- Departmental Budget Allocation Sheet