Business reports are very important for business owners who want to see how well their business is working. They ask people in different departments to prepare a report and present it before them because they can’t keep an eye on everything, and therefore, they rely on the report to keep them updated about their business.

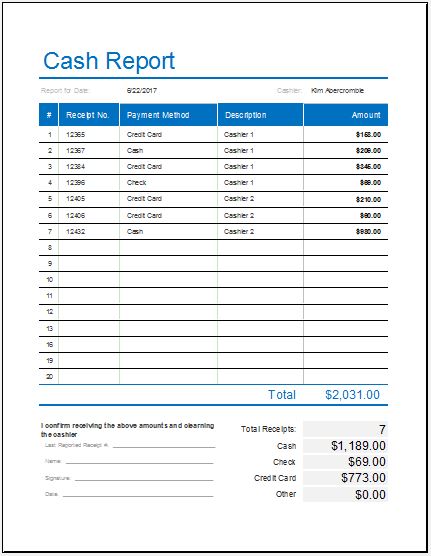

One of the most widely used reports is the daily cash report. It is generally created to keep an eye on the cash that is received by a company on a given day from numerous sources.

What is a daily cash report?

It is a statement of a business that is used by the stakeholders of the company to supervise the working of the company. Many transactions are carried out each day. Some transactions are carried out in cash. It is essential for a business to keep a record of such transactions, and for this purpose, a daily cash report is prepared.

With the help of the cash report, you will be able to see the cash amount that was paid and received on a given day. A lot of other details will also be summarized in this report. For details, the database or register can be consulted.

How important is it to use a daily money flow report?

When a report giving a clear picture of the inflow and outflow of cash is reviewed, people find it very easy to determine the health of a corporation. Monitoring and managing the flow of cash is essential for a company that is looking forward to several things happening before it can be in a position to make crucial decisions. A report shows that a company is effectively practicing recordkeeping and is aware of everything that is happening.

What are the elements of the cash report?

If you are creating your report, you should know about the important elements that should never be missed. Here is the list of those items:

- Date of report generation:

The date on which the report was generated is mentioned at the top because it tells how old it is. The more recent a statement, the more valuable it will be for people who are reading it to manipulate it.

- Opening balance:

This part of the report points to the balance a business had at the start of the month or the start of the period from which the report is taking the data.

- Inflow of cash details:

In this section, it is required to mention all the inflows of cash. The sources from which the cash was collected will be mentioned here. It often includes the sale of products, the collection of outstanding payments, or other sources. A business has a different record sheet for all these collections, and those sheets are also updated along with the daily cash report.

- The outflow of cash

This part discusses the cash amount that was paid to external entities from the balance or repository of the company. A company usually pays when it has to pay its outstanding dues, when it purchases products for its inventory, or when it pays to fulfill its other needs.

- Closing balance:

At the end of the day, the amount left in the cash repository of a company is mentioned. This shows a company is left with another day to start. Those who are handling the cash are often answerable to the stakeholders if it is seen that there is any discrepancy.

Usually, it is not easy to find a discrepancy, but when a report is created, everything becomes crystal clear.

In addition to the details mentioned above, there can be a lot more to show in the report. What you want to show entirely depends on the individual needs of the company and what an accountant has been instructed to add to the report.

Using a template helps to know the format of the report, as many people struggle with the format because they don’t know how to show different essential components in the report to make it a useful document.

File: Excel (.xls) 2003+

- Quarterly Tax Payment Tracker

- Payroll Tracker for Excel

- Delivery Route Optimization Worksheet

- Energy Consumption Monitoring Worksheet

- Return on Investment (ROI) Calculator

- Investment Portfolio Tracker

- Equipment Utilization Worksheet

- Emissions Monitoring Worksheet

- Monthly Utility Consumption Worksheet

- Sales Tax Calculation Sheet

- Fixed Asset Register Template

- Advance Salary Tracker

- Benefits and Deductions Worksheet

- Capital Expenditure Tracker Template

- Departmental Budget Allocation Sheet