Those who travel for work-related purposes need to be properly reimbursed for this. It is important to record details about the trip and the distance covered so that you can be compensated. Your company may have a policy to reimburse employees according to the gas they have used for a work-related trip.

If this is the case, it is necessary to record the money you have spent on gas accordingly. This will help you keep tabs on gasoline expenses. To record this information effectively, a gas mileage log can be used.

What is a gas mileage log?

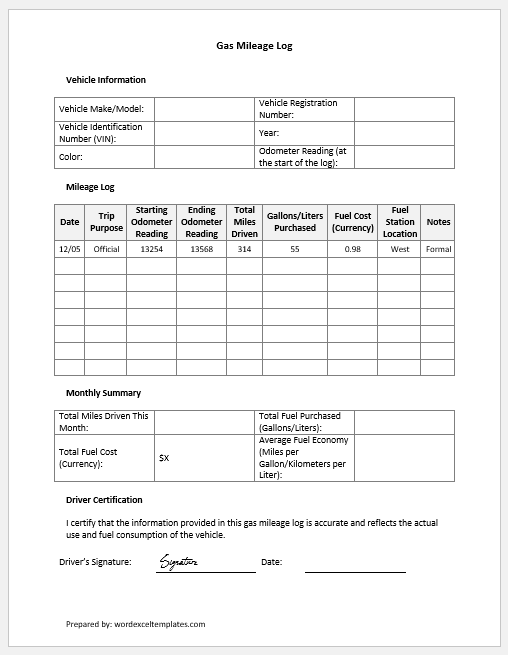

This is a document that records your gasoline costs as well as mileage. To do this various details are included like the liters brought, price per liter, mileage covered, total amount of gasoline spent, etc.

What does a gas mileage log do?

The log will record details that will help you and those concerned to know how much money you spend on gas. The price of the gasoline will be stated and so known. The log will track the mileage covered as well so that the distance you have traveled can be known.

File: Word (.docx) 2007/+ and iPad

Size 29 KB

The log must be relevant and so only include important details such as the following:

Select application:

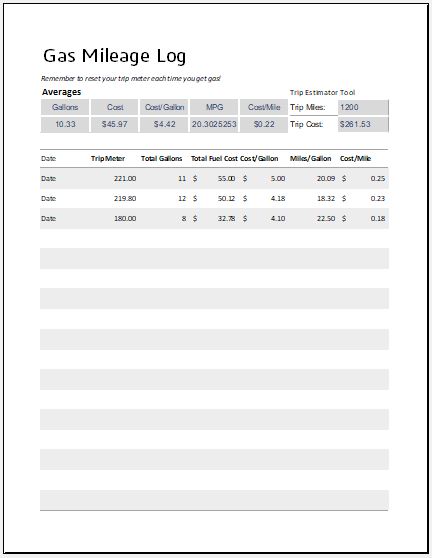

The log can be made in Microsoft Excel so that you can create a table easily and carry out any calculations when they are needed. Microsoft Excel will help you do this easily. You need to keep in mind the employees who need to fill in the log and make it so that it is easy for them to do this.

Format of document:

The document should begin with a heading which can be “Gas Mileage Log”. It is important to have a clear heading that lets readers know what the document deals with. You can then make a table that includes the details about the gas mileage.

Details to add:

You can make a table and add the vital details to it. Add information that is needed if you want the table to be easy to fill in and include the details in simple words. The table can have columns such as the date of the trip. Another column will be for the miles traveled and another one for galleons or liters brought. The total fill-up expense can be given in another column.

You will need to state the cost per gallon. The miles per gallon can be given in a column and the cost per mile in another one. You may have a column that records the odometer readings such as the start and stop readings so that the accurate distance travelled can be known. Figure out what information is important and related to how much gas has been used for a business trip and only include details connected to this.

The log is helpful…

Those who need to keep an accurate track of any business-connected gas costs should do this properly so that they can be reimbursed. A gas mileage log such as this one can be used here. The log will help in calculating the expense of the trip connected to the distance that has been traveled for it and the gas used. The cost of gas needs to be stated so that the reader knows that the cost of gasoline has been calculated properly.

The vehicle’s mileage needs to be given as well so that the distance traveled for the trip will be known. The log is helpful as it can aid one in figuring out the cost of gas that will be used for a certain trip. One can then arrange for the trip without facing complications during it. The log is used to even track the actual costs of different business-connected trips. The log can be used by a company to keep a record of how much money they have paid employees for gasoline used.

It can therefore be used for budgeting purposes. The employee who travels for work-related activities will be able to record gas used for the trip accurately and in an easy way without getting confused. The document is even able to be used for tax purposes and if needed in any legal proceedings involving the employee and the company.

File: Excel (.xls) 2003+ and iPad

Size 22 Kb

- Quarterly Tax Payment Tracker

- Payroll Tracker for Excel

- Delivery Route Optimization Worksheet

- Energy Consumption Monitoring Worksheet

- Return on Investment (ROI) Calculator

- Investment Portfolio Tracker

- Equipment Utilization Worksheet

- Emissions Monitoring Worksheet

- Monthly Utility Consumption Worksheet

- Sales Tax Calculation Sheet

- Fixed Asset Register Template

- Advance Salary Tracker

- Benefits and Deductions Worksheet

- Capital Expenditure Tracker Template

- Departmental Budget Allocation Sheet