One of the most salient features of every business is its financial aspect. Managing assets, liabilities, profits, and losses is crucial to success. A business’s growth cannot be determined unless a proper record is maintained for its finances. This area must be organized before a company can thrive.

Accountants are hired for this purpose. They are entrusted with the critical job of maintaining financial statements. The most useful of such statements is a balance sheet. Every business owner and accountant appreciates its vital functionality.

It is one of the three major financial statements maintained by every organization—the income statement and cash flow statement are the other two. These measures are used to evaluate a business’s financial state at a given time, and this information is of immense significance for business owners and shareholders.

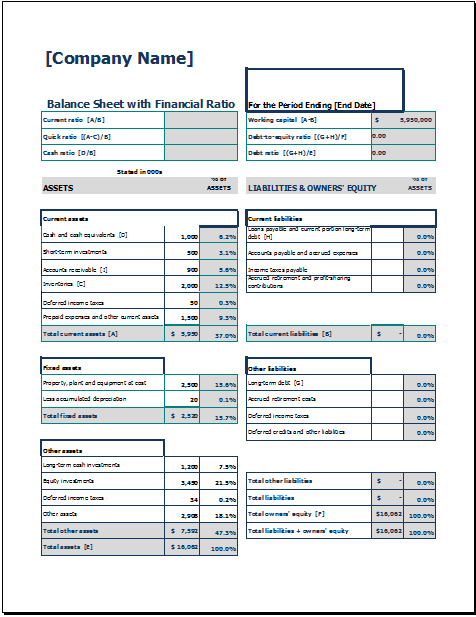

A balance sheet is a document that represents the entire collection of assets and capital owned by a particular business. After calculation, the net asset value should be equal to the capital and net profit a business achieves at the end of its financial year.

This balance is important to indicate success. However, a low net asset value represents a loss. Overall, this information helps in planning the finances for the coming years. In addition, a business’s financial strengths and weaknesses can also be determined.

A balance sheet representing financial ratios is more useful for these evaluations. These ratios are calculated using the information provided by various financial statements. In the end, the calculated ratios are essential in analyzing trends.

Moreover, these financial ratios are also used to compare the financial conditions of various organizations. The results may act as an indicator of a firm’s future bankruptcy.

Therefore, a balance sheet with the financial ratio is important for creating future action plans. Experienced accountants make the calculations. Business owners must also have an understanding of these consequential financial statements.

It is necessary to supervise the hired accountants. An online template for a balance sheet can be used to yield perfect results.

Preview and Details of Template

File: Excel (.xls) and iPad

Size 36 KB

- Summer Vacation Planner

- Outlet Mall Shopping Planner

- Customer Information and Ranking Sheet

- Small Family Kitchen Design Planning Sheet

- Summer Party Budget Sheet

- Payroll Register & Salary Sheet

- Employee Skill Development Tracker

- HR Budget & Expense Tracker

- Leave & Vacation Tracker Template

- Exit/Off-boarding Checklist

- Performance Evaluation Sheet

- New Year Goal Setting Worksheet

- Workforce Planning & Headcount Forecast Sheet

- Christmas Countdown Calendar

- Year-End Financial Summary Template