In the intricate world of event planning, success often hinges on the meticulous management of resources. At the heart of this management lies the event budget. An event budget is more than just a financial plan; it is a strategic roadmap that ensures your event sails smoothly from conception to execution.

In this article, we explore the basics of event budgeting, including its definition, key stakeholders, benefits, and a step-by-step guide to creating an effective budget.

What is an event budget?

An event budget is a comprehensive financial plan that outlines all the anticipated expenses and revenue for a specific event. Whether you’re organizing a corporate conference, a wedding, or a music festival, the event budget serves as a guiding framework for financial decision-making.

It involves forecasting costs, identifying potential income streams, and ultimately aims to keep the event financially viable.

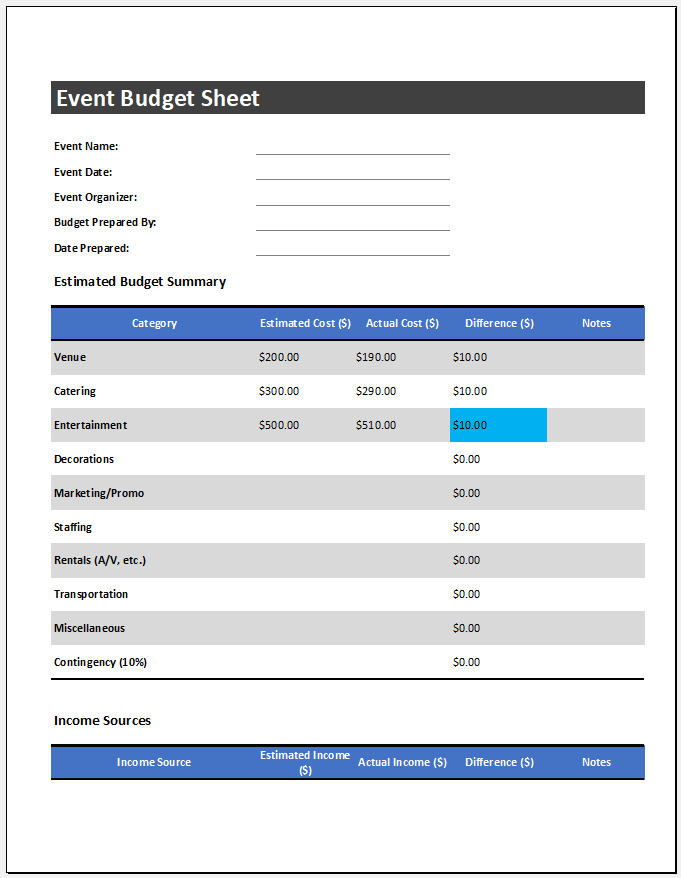

Format: MS Excel

Who uses the event budget?

Event budgets are not exclusive to event planners; they serve as invaluable tools for various stakeholders involved in the event. Naturally, event planners are at the forefront of utilizing event budgets.

They rely on these financial blueprints to make informed decisions, allocate resources effectively, and ensure that the event meets its financial objectives. Clients funding the event and sponsors providing financial support depend on the budget to understand where their money is going.

It establishes transparency and trust between event organizers and those investing in the event. For those managing the event venue, the budget provides insights into space utilization, equipment needs, and any additional services required.

This information is crucial for ensuring the venue is adequately prepared to host the event. The marketing and promotion teams leverage the budget to understand the financial scope for advertising, promotional materials, and other marketing strategies. This helps align promotional efforts with the overall financial plan.

What are the benefits of using an event budget?

Creating and adhering to an event budget offers a multitude of benefits that extend beyond just financial management. Here are some key advantages:

Financial ControlPerhaps the most obvious benefit is the control it provides over financial resources. The budget acts as a guardrail, preventing overspending and helping organizers stay within their financial limits.

Risk Mitigation

Event planners can identify and mitigate risks early in the planning process by foreseeing potential costs and revenue streams. This proactive approach minimizes the likelihood of financial surprises during the event.

Resource Allocation

The budget assists in allocating resources optimally. Whether assigning funds to specific aspects of the event or determining the number of staff required, the budget guides decisions that contribute to overall efficiency.

Performance Measurement

After the event, the budget is a benchmark for evaluating financial performance. By comparing actual expenditures and revenues against the budget, event planners can assess the event’s financial success and identify areas for improvement in future events.

Creating an event budget sheet?

Now that we understand the importance of event budgets let’s explore the step-by-step process of creating one.

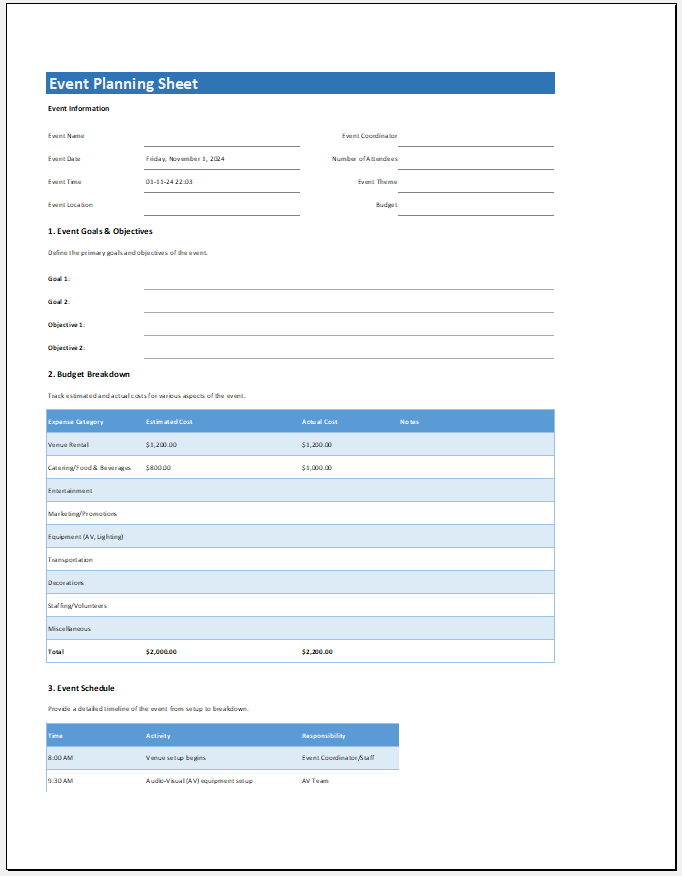

Define Your Event Objectives and Scope

Before delving into the numbers, establish clear objectives for your event. What do you want to achieve? Who is your target audience? Understanding the purpose and scope of your event will guide budget decisions.

Identify Revenue Streams

List all potential sources of income for your event. This may include ticket sales, sponsorships, merchandise sales, and other revenue-generating activities. Be realistic in your projections and consider both primary and secondary revenue streams.

Outline Expenses

Create a comprehensive list of all potential expenses associated with your event. This includes venue costs, catering, equipment rentals, marketing and promotional expenses, staff wages, and miscellaneous costs. Research and gather quotes to ensure accurate estimates.

Categorize Expenses

Organize your expenses into categories to make the budget more manageable. Common categories include venue and production, marketing and promotion, personnel, catering, transportation, and miscellaneous. This categorization helps you better understand and control costs.

Allocate Budget to Each Category

Based on your estimates, allocate a budget to each category. Ensure that the total projected expenses do not exceed the total projected revenue. Adjust allocations as needed to maintain a balanced budget.

Contingency Planning

Incorporate a contingency fund into your budget to account for unforeseen expenses or emergencies. A common practice is to allocate around 10% of the total budget to cover unexpected costs.

Regularly Update and Revise

As your event progresses, regularly update your budget to reflect actual expenditures and revenues. This allows you to identify discrepancies early on and make necessary adjustments to stay on track.

Format: MS Excel

- Employee Scrutiny & Evaluation Forms

- Christmas Decoration Inventory Sheet

- Contractor Entry Log Template

- Holiday Party Planner Template

- Employee Training and Development Forms

- Customer Service and Support Forms

- Commonly Used Forms for Payroll Correction

- Employee Exit Forms

- Employee Orientation Forms

- Christmas Shopping Budget Planner

- Office Discipline & Violation Forms

- Christmas Gift List Template

- Employee Payroll and Promotion Forms

- Forms for Termination of Employment

- Marketing Forms Used by Businesses

- HR-related Form Templates

- Personal Finance Tracker

- Daily Dog Care Checklist