A payroll is a most frequently used document due to which it has a lot of importance. A payroll document includes the details of the person for whom it is created, including the name, salary, date of issuance, and a lot more. Due to all these details, the payroll is deemed as very important.

In general, the payroll provides the details about the salary an employee gets each month by working in the company. The details regarding the increments, bonuses, discounts, deductions from the salary, and a lot more are also mentioned in the payroll.

Sometimes, the employee faces a problem like a problem in the payroll. Sometimes, a company encounters a problem in the database due to which the wrong details in the payroll are mentioned. When the employee wants these incorrect details to be corrected, he is required to use the payroll correction form.

What is a payroll correction form?

The payroll correction form is a document that is used by the employee when he wants several corrections to be made to the payroll. Using the payroll correction form enables the employee to get the payroll corrected.

When should the payroll correction form used?

An employee can use the payroll correction form when he finds any mistake in the payroll. The mistake in the payroll can be based on incorrect calculations or associated with typing.

A payroll correction form is also used when irregularities in the payroll form are seen. If there is an unnecessary deduction from the salary, the correction form is used to get it corrected.

In other words, the payroll correction form is a type of request form through which the employee submits the request to review the payroll to check if there is any mistake. it is a formal way to inform the employer about the mistake that you have seen in the payroll.

What should be included in the payroll correction form?

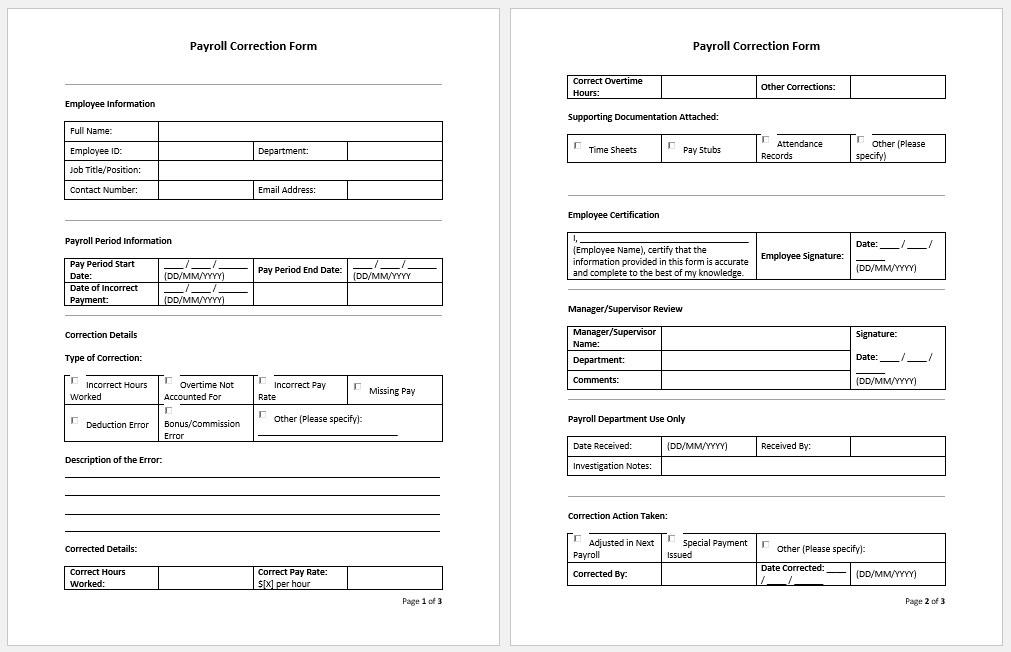

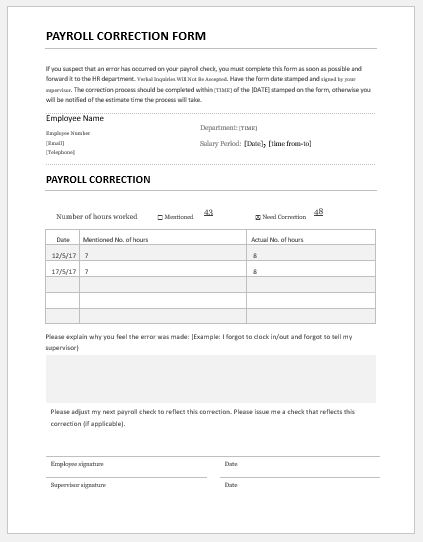

A payroll correction form includes the following details:

- Name and other details of the employee who has been issued the payroll

- Mention the department in which the employee works

- The details of the correction that the employee wants to be done in the payroll

- The amount of pay that needs to be changed

- The details of the correction

- Signatures of the employee

The template:

The payroll correction form provides a pre-designed correction form that does not require the user to put effort into designing the form from scratch. In this way, the template saves time and energy. The best feature of the template is that it is easy to customize according to his needs.

The form is prepared in MS Word format. There are also many other formats in which the form can be created. These templates have all the details already mentioned. The user just needed to fill in the required fields and then submit the form.

File: Word (.docx) 2007+ and iPad

Size 52 KB

- Forms used for Operations in an Organization

- Procurement/Supply Chain Forms

- Employee Skill Development Tracker

- HR Budget & Expense Tracker

- Leave & Vacation Tracker Template

- Exit/Off-boarding Checklist

- Downloadable Forms for Unprofessional Behavior

- Commonly Downloaded Office Forms

- Performance Evaluation Sheet

- New Year Goal Setting Worksheet

- Workforce Planning & Headcount Forecast Sheet

- Christmas Countdown Calendar

- Year-End Financial Summary Template

- Compliance & Policy Acknowledgement Sheet

- Job Description & Role Matrix Sheet